Unmasking Lquid.Finance: A Deep Dive Into Its Deceptive Practices

Unmasking Lquid.Finance: A Deep Dive Into Its Deceptive Practices

If you’ve come across Lquid.Finance or LquidPay, you may be wondering if their promises of seamless crypto-to-fiat conversion, “zero APR,” and “non-custodial wallets” are too good to be true. Spoiler alert: they probably are.

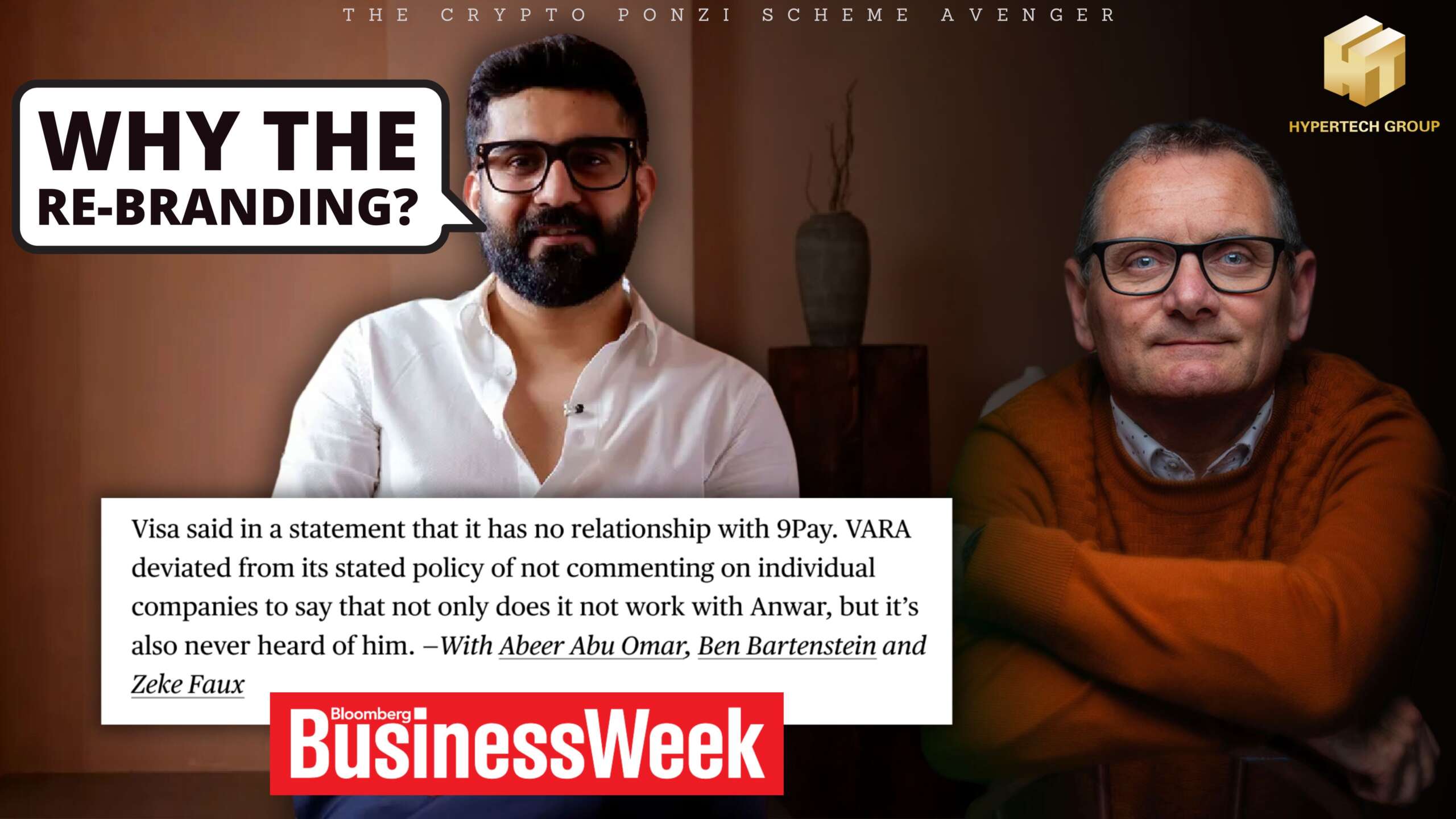

In this blog, we re-stream Stealthy Surveillance‘s in-depth investigation into Lquid.Finance and its alarming red flags. This platform has been linked to questionable schemes like “We Are All Satoshi,” spearheaded by Shavez Anwar, raising serious concerns about its legitimacy. If you’re searching for answers or suspect something isn’t quite right with LquidPay, you’re in the right place.

Watch the Full Investigation

Discover the shocking truths behind Lquid.Finance in Stealthy Surveillance’s original investigation:

Exposing the Deception: A Brutal Truth Review of Lquid.Finance

Explore more content from Stealthy Surveillance here:

Stealthy Surveillance YouTube Channel

The 13 Red Flags of Lquid.Finance

Before diving into the details, let’s outline the major red flags Stealthy Surveillance uncovered about Lquid.Finance and its payment service, LquidPay:

- Lack of Transparent Information

- No clearly named issuer or regulated financial partner for the cards.

- Merida Ltd., the company behind the platform, lacks authorization for handling custodial funds or payment services.

- Misleading “Powered by Visa” Claims

- Despite heavy Visa branding, there’s no evidence of an official partnership with Visa.

- Genuine Visa-backed cards disclose licensed issuers—LquidPay doesn’t.

- Non-Custodial Wallet Misrepresentation

- Claims to offer non-custodial wallets, yet user assets are fully controlled by the company, contradicting the claim.

- Terms allow freezing, converting, or seizing user collateral without prior notice.

- High and Ambiguous Fees

- Transaction fees “up to 2.3% + $0.50” and penalties as high as $69 remain unclear.

- Fees are non-refundable, even if errors are caused by the platform.

- Unrealistic Promises

- “Zero APR” and “no annual fees” seem unsustainable when paired with cashback rewards and premium services.

- Unlicensed Credit Services

- Offering credit based on volatile crypto assets without proper licensing.

- Buzzwords Without Substance

- Terms like “instant crypto-to-fiat conversion” lack transparency about rates, third-party partnerships, or hidden costs.

- Opaque KYC/AML Compliance

- Claims adherence to compliance but fails to provide jurisdiction-specific evidence.

- Complex Legal Terms

- Jurisdictional operations in Hong Kong but arbitration disputes handled in Singapore complicate legal recourse.

- Binding arbitration clauses restrict user rights to class-action lawsuits.

- High-Limit Spending Focus

- Marketing luxury cards with high transaction limits may target high-net-worth individuals for significant deposits.

- Unverified Roadmap Features

- Grand claims of “100+ premium benefits” and multi-chain support lack timelines or development proof.

- Recent Launch Date

- With a December 2024 launch date, the platform has no proven track record or independent reviews.

- Privacy Concerns

- Collects sensitive user data like SSNs and biometric information without clear security protocols.

Why You Should Be Concerned

Platforms like Lquid.Finance are masters of disguise. They leverage buzzwords, flashy marketing, and the trust associated with terms like “Visa-powered” to mask their lack of transparency. If you’re an investor considering their services, here’s why you should think twice:

- Financial Risks: Custodial setups disguised as non-custodial wallets expose you to fund mismanagement or outright theft.

- Legal Vulnerability: Complex terms, arbitration clauses, and lack of regulatory oversight leave users with little to no recourse.

- Exaggerated Promises: Zero APR, no fees, and instant conversion sound great—but rarely deliver without hidden costs.

How You Can Protect Yourself

- Read the Fine Print: Platforms like Lquid.Finance rely on users skipping the details. Read everything before investing.

- Verify Claims: “Powered by Visa” or “non-custodial wallet” claims can be misleading. Always verify partnerships and licenses.

- Stay Informed: Follow trusted sources like Stealthy Surveillance and The Crypto Ponzi Scheme Avenger to keep up with the latest scams.

- Ask Tough Questions: If a platform’s terms don’t make sense, ask questions—or better yet, walk away.

Join the Fight Against Scams

At The Crypto Ponzi Scheme Avenger, my mission is simple: to expose fraud, shame the scammers, and save investors from devastating losses. But I can’t do it alone. Here’s how you can help:

- Watch the Video: Get informed and arm yourself with the knowledge to avoid scams.

- Share the Blog: Spread the word about Lquid.Finance and its red flags.

- Submit Tips: If you’ve encountered similar platforms or scams, let me know.

Final Thoughts

Lquid.Finance isn’t just another crypto platform—it’s a potential trap waiting to exploit unsuspecting investors. By exposing its deceptive practices, we aim to educate the public and prevent further financial losses.

Don’t miss this must-watch re-stream of Stealthy Surveillance’s investigation. Tune in, learn, and help us hold these scammers accountable. Together, we can make the crypto space safer for everyone.

Stay vigilant, stay informed, and always remember: If it sounds too good to be true, it probably is.

Leave A Comment