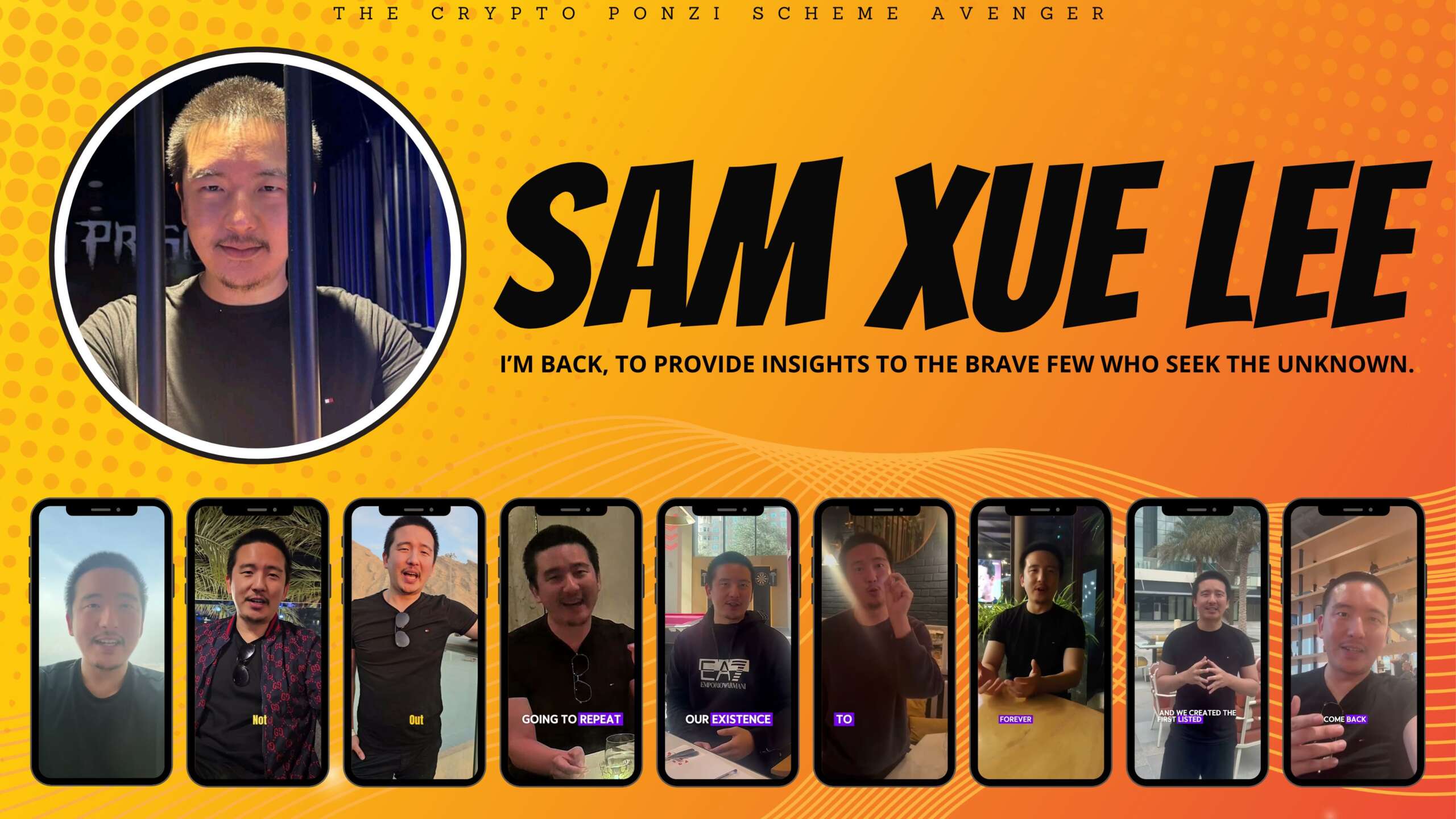

Sam Lee, the self-proclaimed blockchain visionary and the man behind the $1.9 billion Hyperverse Ponzi scheme, has resurfaced in a series of nine YouTube videos.

Sam Lee, the self-proclaimed blockchain visionary and the man behind the $1.9 billion Hyperverse Ponzi scheme, has resurfaced in a series of nine YouTube videos.

With a tone of arrogance and a recycled narrative, Sam lays out a five-year plan to bring the “mainstream global economy” onto blockchain technology. However, his plans sound eerily similar to the tactics that led to Hyperverse’s collapse, defrauding thousands of investors.

While Sam is an Australian citizen, his legal troubles span across international borders. With charges from the United States tied to his involvement in Hyperverse and an Interpol Red Notice previously issued, it’s only a matter of time before he’s held accountable. When he steps foot in the U.S., authorities are likely to detain him, potentially leading to a prison sentence of up to five years for financial crimes.

Here’s a breakdown of Sam Lee’s latest videos, his proposals, and why this could be the beginning of yet another scam.

Sam’s Arrogant Comeback

In these nine videos, filmed from undisclosed locations, Sam Lee makes bold claims about his ability to revolutionize the blockchain industry. He starts by acknowledging the legal challenges he’s faced, including his $1.89 billion civil case in the U.S. and his detention in Dubai under an Interpol Red Notice. However, Sam dismisses these as “fabricated charges” and claims he’s been “cleared” and is now “indestructible.”

Sam’s tone is strikingly arrogant. He positions himself as the only person capable of leading a new blockchain revolution, criticizing regulators and dismissing past failures as the result of others’ dishonesty. This refusal to take accountability for the devastation caused by Hyperverse is a glaring red flag.

Recycling Old Tactics

Sam Lee’s five-year plan is nothing new. In fact, it’s a blatant rehash of the same affiliate marketing and tokenomics model that Hyperverse used to defraud investors. Here’s what he’s proposing:

- Affiliate Marketing: Sam praises affiliate marketing as a “longer-term model” and criticizes regulators for warning against it. He claims that affiliate marketing ensures the sustainability of blockchain projects, conveniently ignoring how it was central to Hyperverse’s downfall.

- Tokenomics and Staking: He plans to relaunch a 3x rewards model for token distribution and staking, similar to what he introduced in 2019 with Hyper Capital. This model promised unrealistic returns and left countless investors holding worthless assets.

- Get in First: Sam repeatedly urges his audience to “be first” in his new venture, referencing past successes in Bitcoin and blockchain startups. However, this emphasis on urgency is a classic Ponzi scheme tactic designed to pressure people into investing without proper due diligence.

Manipulating the Narrative

Sam positions himself as a misunderstood visionary who has been wrongfully accused. In his videos, he thanks regulators, leaders, and followers for their trust, while dismissing critics as dishonest and irrelevant. This manipulative messaging serves to rally his supporters while silencing dissenting voices.

He claims that 2025 will be a “pivot point” for success and invites his followers to join him on a “revolutionary” journey. However, his refusal to address the harm caused by Hyperverse and his reliance on the same failed models make it clear that his intentions are far from revolutionary.

The Legal Reality

Despite Sam’s attempts to portray himself as a victim, the legal reality paints a very different picture. The U.S. Securities and Exchange Commission (SEC) has charged him in connection with the $1.9 billion Hyperverse fraud, one of the largest crypto scams in history. His detention in Dubai under an Interpol Red Notice was a significant step forward, but his release after seven days raised questions about the strength of the case or his potential influence.

If Sam travels to the United States, he is likely to face arrest and prosecution. A conviction could result in up to five years in prison for financial crimes. Given the scale of the fraud and the number of victims, justice demands accountability for Sam’s actions.

Why This Matters

Sam Lee’s reappearance and his plans for 2025 serve as a stark reminder of the risks in the crypto space. While cryptocurrency offers exciting opportunities, it also attracts bad actors who exploit the unregulated nature of the industry. Scandals like Hyperverse highlight the importance of due diligence and the need for greater transparency in crypto investments.

For investors, regulators, and the broader crypto community, Sam’s story is a case study in the dangers of blind trust and unchecked arrogance. His continued attempts to rebuild and recruit underscore the need for vigilance and accountability.

Red Flags to Watch Out For

Sam’s new venture is riddled with red flags, including:

- Recycled Models: The reliance on affiliate marketing and tokenomics mirrors every hallmark of a Ponzi scheme.

- Arrogance Over Accountability: Sam’s dismissal of legal charges and his refusal to take responsibility for Hyperverse’s collapse are troubling.

- Manipulative Messaging: His calls for loyalty and his framing of critics as dishonest are classic tactics used by scammers to maintain control.

- Lack of Transparency: Sam’s vague promises and undisclosed plans leave more questions than answers.

New Discovery: SatoshisTable.com and Red Flags from the Pitch Deck

During the live broadcast, we uncovered Sam Lee’s new website, SatoshisTable.com, which appears to be the foundation of his latest venture. Along with the website, we also found a pitch deck outlining the opportunity he’s promoting. After analyzing the presentation using ChatGPT, numerous red flags emerged, raising serious concerns about the legitimacy of this project.

Here are some of the critical issues identified in the pitch deck:

- Unrealistic Returns: Promises of 15%-30% monthly returns and up to 300% total yield (3X) are highly unrealistic and mirror classic Ponzi scheme tactics.

- Complex Reward Structure: Terms like “accelerated unilevel,” “VIP rewards,” and “global rewards” emphasize recruitment over tangible value, which is a hallmark of pyramid schemes.

- Dependency on Recruitment: The earnings system relies heavily on multilevel referral commissions, a red flag for scams.

- Vague Product Offering: The so-called “Hyper Wealth Package” lacks any clear value or utility, focusing instead on financial returns.

- Lack of Transparency: References to “OUR PARTNERS” are vague, with no details provided—something legitimate businesses would disclose.

- High Fees and Restrictions: Withdrawal fees, conversion fees, and other hurdles make accessing funds unnecessarily complicated, possibly to deter payouts.

- Internal Tokens: The use of proprietary tokens like HyperUSD or HyperCash creates a closed-loop system, obscuring financial transparency and real asset value.

- Rebranding Warning: The structure and language are eerily similar to past schemes like HyperFund and HyperCapital, raising suspicions of a rebranded scam.

- No Regulatory Oversight: There is no mention of compliance, audits, or licenses, a critical warning sign for any financial opportunity.

For full transparency, you can download the Pitch Deck PDF to review the findings yourself. Additionally, we recommend taking a look at SatoshisTable.com to better understand the claims and evaluate the risks.

This discovery reinforces the importance of vigilance and due diligence. Stay informed and think critically before engaging with opportunities like this.

Final Thoughts

Sam Lee’s latest videos are not the comeback of a misunderstood visionary—they are the prelude to what could be another large-scale crypto scam. His arrogance, lack of accountability, and recycled tactics make it clear that his new venture is built on the same foundation as Hyperverse.

With legal challenges still looming and potential prison time on the horizon, Sam’s time may be running out. For now, the best defense against his schemes is awareness and education. By exposing his tactics and highlighting the red flags, we can help prevent more people from falling victim to his deception.

Stay vigilant, stay informed, and don’t let history repeat itself. Sam Lee may be free for now, but justice has a way of catching up with those who exploit others for personal gain.

Leave A Comment