Facilitated by DANNY : DE HEK meetings are recorded for our Podcast, we’ve been doing this since COVID-19 if you’re interested in joining in with us check out our Website.

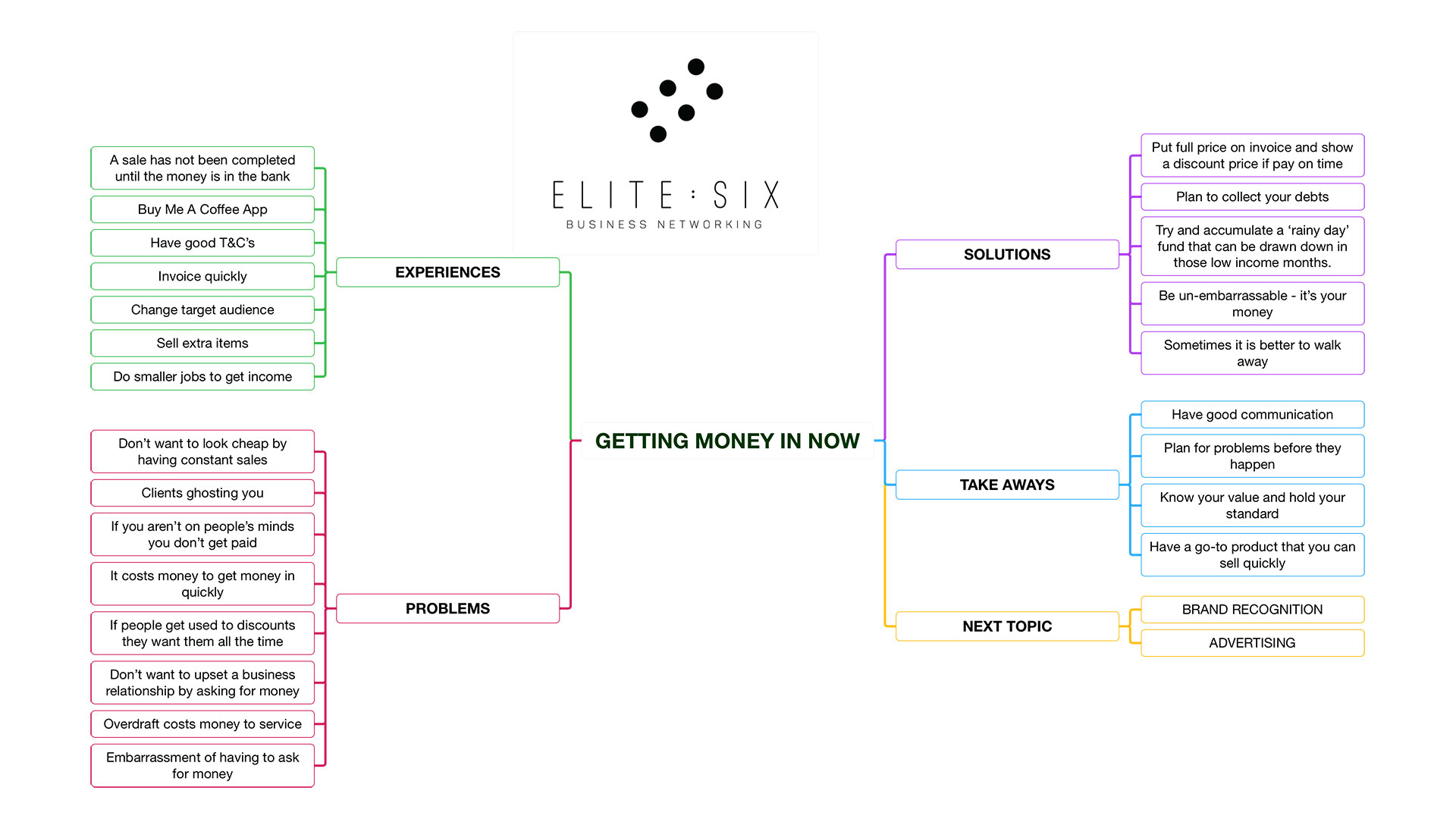

DANNY : DE HEK: [00:00:00] Welcome to, uh, ELITE : SIX think tank meeting and you’re listening to one, two, three, four, five, six people who are members of ELITE : SIX. You get together each week to discuss the topic. Today’s theme is actually. Getting money in now we talked about grabbing some low hanging fruit from your business when you need to get some money.

And then we’ve just got a think tank meeting and progress, but I just wanted to go around the room quickly and just introducing who’s in the room. So, Paul, would you like to introduce yourself please?

Paul Starling: [00:00:28] Yep. Um, pull stalling. Um, Paul Starling I am based out in Rangiora North Canterbury, about 40 minutes North of Christchurch and I run Canterbury Computer Services. And we provide it services for small businesses and home users. And for little sidekick, I also have Kiwi Souvenirs, and we send soft and fluffy toys all over the world.

DANNY : DE HEK: [00:00:51] Thank you very much. And Lachland.

Lachlan McNeill: [00:00:53] Yes. I’m Lachlan McNeill. I have a company called a Acorva recruitment with technical recruiters, dealing with engineers and architects and the like, and I also have, uh, an on-brand, which I’m developing called earn your crust, which is all about the wiggling world of work and a small business.

Mark Scown: [00:01:10] Yeah, Mark Scown an insurance broker, but it’s clients ranging from Auckland to Dunedin and a West coast based in North Canterbury though. I specialize in personal and small risk business risk, uh, insurance, but my particular specialty is being able to provide a restructuring of existing clients and insurances to give them a long-term affordability and sustainability by getting into, um, levelled premiums and the core elements.

DANNY : DE HEK: [00:01:38] Thank you, Rob.

Rob Woolley: [00:01:39] My name is Mr. Woolley and I run Academy and ticks in Academy training Academy and takes specializes on English, porcelain and Academy training specializes on teaching you, uh, public speaking, presenting skills, leadership management skills, basically anything with wisdom.

DANNY : DE HEK: [00:01:58] Helen.

Helen Oakes: [00:02:00] I’m Helen Oakes. I am a photographer, a digital creator and an educator, and I also have some online stores.

DANNY : DE HEK: [00:02:10] Brilliant Lance.

Lance Hastie: [00:02:10] Lance Hastie order of com technology, technology business that specializes in solving technology and business and developing solutions to get you out of that pain point. And it could be a. Microcontroller solution with focuses in the, uh, agricultural primary industry sector with internet of things, technology. So that’s, um, taking sensory data and using the cloud to improve your productivity and, uh, business life

DANNY : DE HEK: [00:02:46] brilliant and last, but definitely not least is David Clarkson.

David Clarkson: [00:02:49] Hi, I’m David Clarkson from dynamic communication and we. Rob, uh, public speaking and presentation skills trainers. And we also do training around soft business skills. So I like to say that, uh, we build more confident, more competent, more credible communicators, so that for people who. They’ve got to start and prepare a speech and don’t know where to start they should give us a call and if people have ever set in a, in a business meeting or any sort of public meeting and, and sit there like a stunned mullet, and afterwards said to themselves, well, I could have said something but more, I should have said something and they didn’t. Then they, you give us a call cause we can help with it. And finally, if you’ve ever done a presentation and at the end of it, you’ve said to yourself, Hey, that sucked then. Sure as hell, you need to give us a call and we can help you with your presentation skills. That’s David klaxon from dynamic communication.

DANNY : DE HEK: [00:03:51] Thank you. And you can find all these peoples in the think I meeting meetings profile, uh, on our show notes, just click on their name and go into their profile.

I’m DANNY : DE HEK, I’m facilitating the meeting and, um, I basically help build people’s personal brands online, and you can read more about us on their website. So today we’ve got a little bit of a different structure than normal. We’re doing a bit more of a quick fire session, uh, the topic for the day is getting money in now.

And what we’ll do is break this into four sections people’s experiences. We’re trying to get money in quickly problems that they may have when doing so some practical the solutions. And then at the end of the meeting, we’ll be talking about some takeaways and then we’ve got some topics already. Outline for a meeting is going forward.

So let’s open the discussion up. And, um, how about you guys tell us, um, your experience with trying to get money in from your business. Um, good and bad stories or welcome. Who would like to have a go first?

David Clarkson: [00:04:52] I’m happy to start an off, Danny. I can always remember back in the day when I was working for an international oil company and I was on the road for them, the credit controller for the company saying to us that a sale has never been made or completed until the money’s in the bank. You know, just, just making a sale is not enough. You’ve got to get the money in the bank. And the quickest way to do that is have extremely clear, um, terms of trade that are signed on to buy new clients when they come up,

DANNY : DE HEK: [00:05:30]

That brings to mind something that I encourage everyone to do. Who’s got a small business, has have a way of collecting money. Like. I created like a PayPal account or, um, uh, we service, I set up the other day that I really like is called buy me a coffee. Often people will use my services. Um, and then I can send them a link saying if you valued my time, want to buy me a coffee, they come along, they can sleep the buy one or coffees, and that money goes straight into my account and it’s no hassle getting that money off people.

So I think that’s a really important thing is to have a way where you can invoice people and maybe clicking the money from credit cards when he could. Hmm.

Lachlan McNeill: [00:06:12] I think Dave, uh, David brought up a good point though, which is w which is, there’s two things we’re talking about. Really one is as a general thing as a business gym to getting money getting paid earlier on the ongoing process.

And the second thing we were sort of referring to is the special occasion. When you get short, caught short, I’ve had situations where I’ve had, you know, many years ago when I’ve had. Bad debts. And suddenly you realise that the client is not going to pay you and you’ve got salaries to pay. So there’s emergency situations, but certainly on the ongoing thing, I’ve found that for me, good terms, conditions, making sure that you discussed them with the client that may affect you, discuss them means that you’re happy to talk about money, but also invoicing quickly.

I found it later by invoice the lady, people paid me. If I took two weeks to invoice that often take a months to pay me. If I invoice that afternoon, I’d get paid in a couple of days. It’s just, they knew I was on the ball. It’s really good.

David Clarkson: [00:07:05]

Yeah. And if you have a large number of clients, there’s an old saying, but I think it still holds true today that the squeaky wheel gets the oil.

If you’re. Constantly at people who haven’t paid their bills by to date, they’ll think of you next to avoid the air, grow of you, make them having to talk to you again and again, and again, you’ve got to be dept collection, especially if you’ve got a large number of clients is something that you’ve got to.

Put time to and be diligent about it because otherwise it’s, you don’t collect the money. It comes straight off your bottom line and that’s an accountant or ex accountant.

Lachlan McNeill: [00:07:48] Yeah, it’s true.

David Clarkson: [00:07:50] And for,

Mark Scown: [00:07:51] from my experience, I’m in an industry that’s becoming ever increasingly regulated being the insurance industry.

And so there’s actually no quick, um, ways to generate income per se. Uh, I’ve got prance on my books that I’m working through a process with. Um, unfortunately I’ve got a number of these clients who are all. Sort of deferring month by month before that we can get to that final application stage. I just have to live with that in the meantime.

Um, I’m receiving no income for me to, to try and generate money and quickly. Um, it’s really turning my attention to that group of people. Typically who are younger are now employed. Uh, so they’ve got a stable income, um, no health issues on the horizon. I can potentially turn them around in two or three weeks.

Uh, and it’s nothing to do with their speed of invoicing. Once they have made application, it has to go through the underwriting and such insurance companies that pay me. And that’s the only way I can speed up my income stream is subtly change my target audience in that group. That’s

DANNY : DE HEK: [00:09:01] funny. Cause I was actually thinking in your industry, you just need a side hustle, something gastro you could do.

Cause I think what I’ve noticed is once you’ve got your business all set up and you’ve got your bullying and you don’t even really have billing in your business, um, you know, then you can do some other activity to get money in. But just what you said was quite interesting to me because obviously you can go after a different type of clientele that actually may be easier to get.

Because I know you are going to the 50 above age group, so yeah. Why not start a new category of content? I’m

Mark Scown: [00:09:31]

already starting? Probably 20% of my clients are under 35 now. So they are always there, but usually they, they process through underwriting faster. There’s no requirements to, for underwriters to go off to your GPS and get records and that all builds in delay.

Um, but in terms of me and operations, I, um, I get probably half. What I’ll do with a client 45 plus.

Lachlan McNeill: [00:09:57] Yeah. So your longer term prospect doesn’t make good to doesn’t make sense to market to that area big time, but then short term, you might just pick up a few of those jobs.

Mark Scown: [00:10:06] There was a spinoff light because they, they are, uh, they become an early client.

They younger and because I’m doing levelled, um, parts of there, there business, that kind of stay with me forever. So there’s an ongoing trail income to come to. So. Yeah. You know, there’s no downside to it.

Lachlan McNeill: [00:10:25] Yeah.

DANNY : DE HEK: [00:10:25] Okay. Good stuff. Anyone else got any experiences like that? Um, yes,

Rob Woolley: [00:10:33] Robin, um, I don’t know there experiences like that, but my industry is slightly different.

If I need to turn over some money in a hurry which is usually because I have to pay income tax Jews too young, like, or, or a holiday is I’ll put extra items online or I will. Quite until all of the items have ended and then I will offer, you know, hundreds of them, um, to, uh, create some extra turnover.

Um, it’s about taking your stock and to. Uh, manipulate your stock. Uh, so that’s how I earn extra money, you know, like at the moment, uh, I don’t want to earn any money at the moment, you know, like, and so I don’t have any items on the door and I won’t have any on until the end of the month. Um, and then I’ll be in and yell at the money, uh, for April, uh, which will help me actually hand over the money that I need to pay at the end of April to the text, man.

Helen Oakes: [00:11:40]

Rob you ever do like bulk amounts, it’s a sale item or you never have things on

Rob Woolley: [00:11:47] it’s just, no, no. I’m not able to do that. I wouldn’t be able to manage that with the type of items I have. Um, but like, for example, you know, if, if, if I’ve owned items, you know, like over a year, um, So I’ve had an opportunity, you know, I a and F I can, uh, Frisco.

Yeah. Like a small amount out of those you like and move them on, you know, then I just, you know, I prefer to move them on. Um, only if I need the money, if I don’t need money, you know, and I can just yell out, remind on there as normal. Yeah.

Lachlan McNeill: [00:12:25] In terms of experiences, um, I certainly have found that in terms of this business recruitment, you’re working on big long-term jobs, but if you suddenly got to bring money in, it does disrupt that process.

You can’t just freeze it. You’ve got to keep in touch with people and keep that rolling. It’s like trying to write two bicycles in some ways and any of that junk, but I’ll often do CVS. I can fit them in, but it’s still in terms of experiences. It can cause a chaos. Um, and there often is a price to pay long-term for having dive around and find some money from somewhere because of that process.

So, you know, it’s not just that put money and it’s the getting the other stuff back on board as well. Back back on track.

Helen Oakes: [00:13:07] So Laughlin, would you put that down and it’s doing

Lachlan McNeill: [00:13:09] something? My experience is it causes chaos. It stops it. So there is a price to pay to doing sheet jobs. And we look at Danny, if he suddenly said they didn’t cheap websites, that causes disruption to what he’s doing on his quality website.

So, so you’ve got to consider it. Um, but, but that’s right. So that’s yeah, in terms of my experiences and my care business, Uh, that was quite hard. Um, get picking workup because we did work for engineering company. So how do you suddenly pick up work? But what it was, what I did do is I found the printing out the beat plans earn me money.

So I would, I would put, I would just sometimes put a quick advert out and say, look, I can, I can plot drawings for you and we’d get that sometimes. But it was quite difficult. I wish I had a side gate going on and in my previous business market business,

DANNY : DE HEK: [00:14:02] Okay, guys just, um, we’re speaking to Tom and not going to be recording this as long as we did previously, but, um, so it sort of quick fire more than anything, really. So any problems that we’re having with getting money in?

Mark Scown: [00:14:16] No, I think that’s a problem that dries up that that is the problem. Yeah, but it often reflects the amount or level of activity you have done in the proceeding months or, or months. And in my industry, when I talked to the business development managers from any particular insurance company, they’re always saying to me, you know, Mark, you just got to keep coming in at the top of the funnel.

You just got to keep putting stuff in there. And, um, you know, that sort of mantra has probably been around for. You know, decades. Uh, and it’s true as though, um, you know, you don’t want to think that you’re just trying to, to, um, feed stuff in because you’re actually trying to deliver a quality product and installing to people.

Lachlan McNeill: [00:15:03] It’s true. Well, my problem is I’ve paid as clients ghosting here, you’re working late busy, busy, busy, you might get placement or something like that. And then suddenly. You know, my, my, my bills, a generally paid within seven days, 7 days, 10 days, 14 days, 21 days. And you send them emails, no reply. So that’s one of my problems is just, no, no, no, no, no communication.

Paul Starling: [00:15:26] One thing I found useful cause both of my guys are on subscriptions and a lot of them are used to paying on the 20th of the month. Hmm. So I basically double billed everybody on months. So they were a month in hand and I also have my, um, The account system set up that if they’re due to pay, they get a reminder email, and if they don’t pay, they get a reminder every seven days. Um, the only downside to that is you’ve got to keep up with, when money goes in the back, you’ve got to make sure that you put it in the system. Otherwise customers will get upset because they get a reminder of something they’ve already paid for. But I found that really improved the cash flow people that were traditionally not paying for a month. And now they’ve got used to the fact that they’re getting all these emails. They don’t like the emails, so they’re just paying.

Lachlan McNeill: [00:16:24] Yeah. Yeah. True. Yeah. That’s more of a solution, but I tell what I’ve found in terms of problems is, is when you offer a discount next time you back on track, normally they’d always remember the discount.

Paul Starling: [00:16:38] Put the price, you only get the discount if they pay on time.

Lachlan McNeill: [00:16:43] But, but the trouble is, is they is, is, you know, temptation sometimes like Danny, if he says, I do you a website for a thousand dollars or 500 bucks. Well, next time people come back, that’s all, I’m one of those $500 websites and you think, well, you know, that’s not on offer anymore. And they feel that the bad guy, so that’s one of the problems.

David Clarkson: [00:17:02] I think if you’ve got a discounting thing going and you say, all you’ve got to do basically is say it as for a set period of time, full stop, and then the offer concludes or finishes.

Mark Scown: [00:17:18]

I think the, um, the, the electricity companies are pretty well now that was the, uh, um, you know, can 10% surcharge.

But if you pay on time, it’ll be this price and that. People just don’t like doing that. So they’re still maintaining there, there, um, budgeted amount. Um, but there’s that 10% inducement in there. So they’re not really genuinely giving a 10% discount there that would probably increase the whole charge across the screen by 10%. And if you pay quickly, you. You can get it.

DANNY : DE HEK: [00:17:49] Yeah. Yeah. $8,000 outstanding on $60 a month invoicing and say, we’ll do the math on that. And then I introduced the $15 late fee and I got $5,000 in, within the month. Wow. Yeah.

Lachlan McNeill: [00:18:04] So, so the solution is people just not taking it seriously, then he is, and then you’re not, you’re not. And it’s what Paul says is that the problem is that you’re, you’re out of people’s minds. Yeah. And

DANNY : DE HEK: [00:18:16] Having real time credit card processing is brilliant for me, somebody the other day. See why don’t you sit up Polly pay, which is basically, uh, a direct debit system, which works very similar to credit card processing and ongoing. But then I had to pay another a hundred or $200 to get that set up on my website for the few people that don’t know how to set up a. A monthly payment on the same day. And it’s about share. Once upon a time, it used to have a hundred people pay me a monthly fee, and I used to charge them on the first of the month.

And that’s how I pay my bills on the 20th. And like Paul said earlier as well, I used to double bill them six week a head. I found that a lot of people had money on the first, the paying the bills because they got paid. On the 25th or 26th from their people. And then the money on the first wasn’t really a biggie because they had money in her account rather than telling me I didn’t have any money at the moment. Pay your bill. Okay. Um,

Lachlan McNeill: [00:19:07] Rob, when you’re putting your stuff online, do you do sort of discount? If you, if you want to get money in the door, would you discount that to get them quicker?

Rob Woolley: [00:19:16] Yeah, there’s a few, um, tactics I have, you know, and it’s interesting hearing everybody else’s a solution to the problem or the cost of, of offering a discount. If I’ve got a regular customer, like most 90% of my customers are quite happy to pay standard price. Um, if I discount I’m training, All of them to expect a lower price. And the sacred is how can I, um, offer the discount to the ones who will need it to buy, but not to anybody else. And the easy way yellows me to do that is that, you know, like you run an auction at the normal amount and after the option has expired, you offer it and you offer it to everybody who doesn’t normally buy from you. Yeah. Um, because the last thing you want to do is if a person is in the habit of purchasing an $80 item is to either hand them an item below 80 bucks, because then their expectation has decreased. And yeah, like there’s no way in my industry that I can say yellow. Well, that was, you know, like a one off. Because there was no one off. Yeah. It ties in as you got at once, you’re going to get it all the time. I think, I think that one thing that I’m hearing and maybe being reminded is that if we want cash and we have to pay for it.

Lachlan McNeill: [00:20:49] Yeah, that’s a good, I think that’s absolutely right. It costs. Yeah.

David Clarkson: [00:20:55] And Rob, if you, I I’m a firm believer if you do decide to do discounting, um, even, even if it’s just a one-off. If you are giving a discount or making a special offer, key thing always is to put the full price on the invoice and then line below it lists are negotiated a discount lists. Summertime’s discount ends 31st of March, something or other like that, and then give them the discount and then show the net price that way then that it reinforces in their mind that an actual fact that they are getting something less than, you know, that they are getting it, the scamp, but then it’s not normal.

Lachlan McNeill: [00:21:46]

Yeah, that’s true. So, so can we put in terms of problems, there’s two problems we identified. One is that people, uh, people think that the discount is sort of forever. And second thing is that Rob said, is it cost money, all just getting money in quickly costs money. Mm mm. So they start our problems. Often it’s can be a fair chunk of your profit.

Rob Woolley: [00:22:09]

I think, I think a solution here because I do have a, I wouldn’t say it’s a solution. It’s a solution I have. And than is, is that I put all of my items on, but they’re not active, which means, you know, I can hit them on or hit them off whenever I want. So I guess a solution to get money in or to avoid needing, to get the money in is to.

Plane work here. How, how much money am I going to have all required any particular time? So they should do your cash

Lachlan McNeill: [00:22:46] Flow. Of course. Yeah.

David Clarkson: [00:22:49] Yeah. And the other planning to go with that. And we’ve talked about it and other sessions is have a systematic approach to it, so that if you normally do it, if you send your accounts out and they’re there to, for whatever they’re to that, you know, within a week after they’ve come in, you review who’s paid and who hasn’t and you straight away get into the people, whoever. Yeah. Yeah.

DANNY : DE HEK: [00:23:19] So just keep the meeting on track there so that we were on just solutions now more than problems, but is there anything else that you can think of that could have been a problem or we, you mentioned a couple of those

Lachlan McNeill: [00:23:28]

before it costs money to, to, to, to get money in quickly. Okay. Costs.

Yeah.

DANNY : DE HEK: [00:23:35] I need to go on a road trip when you’ve got no petrol in the tank. You

Lachlan McNeill: [00:23:38] have. Yep. And then, and the other one was that that you, if you, if you don’t, if people get used to discounts, they think not at all. Yeah.

David Clarkson: [00:23:46] The, the other thing and problems, Danny is a good customer. Who’s suddenly late and you don’t want to upset the relationship by asking for money.

Lachlan McNeill: [00:23:58] Yeah. Yeah. You don’t want, don’t want to face them yet.

Rob Woolley: [00:24:04] I think another one as well as it in reality, right. We can always increase revenue. If we want, which means, you know what, we’ve got to yell at us for an overdraft, you know, like or anything along the lines of that. And and I’ve addressed is not always approved and overdrafts do cost X for money as well.

DANNY : DE HEK: [00:24:23] That’s a good point. It’s slave you have financing other peoples theoretically not, you

Lachlan McNeill: [00:24:28] have an overdraft, you using the, using me as a bank. The problem is embarrassment, frankly. You know, this just put the embarrassment. There’s the barest of all having to chase money.

DANNY : DE HEK: [00:24:40] You know, I felt when I had $8,000 outstanding from my members, which I love

Lachlan McNeill: [00:24:46] The embarrassment. I think we need to put that down as a problem. It is. Well,

David Clarkson: [00:24:50] That’s pretty much, that’s pretty much what that was the thing I was talking

Lachlan McNeill: [00:24:55] about. Yeah, that’s right. I just want to get on the list.

DANNY : DE HEK: [00:24:58]

It really good points.

Lachlan McNeill: [00:25:00]

Great points.

Helen Oakes: [00:25:02] How do you spell embarrassment?

DANNY : DE HEK: [00:25:03] All right. So some solutions would be, um, we did talk a few, then we actually, yeah, it was

Mark Scown: [00:25:09] Planning your debts. And I’ve just put down on shit. Um, you know, I try and accumulate a rainy day fund that can be drawn down on those low income months. Um, certainly in a industry where in any given year I could have up to three of those months a year. You’ve got to have a really good year to be able to, um, I mean, meet all your tax, things as Rob saying, but also, um, you know, my, my rainy day fund at the moment is running on empty.

Lachlan McNeill: [00:25:42] Sell the Island behind ya.

DANNY : DE HEK: [00:25:45] I just

Mark Scown: [00:25:46]

signed the weight that I don’t own the land part.

That’s the time.

DANNY : DE HEK: [00:25:49] Okay. And

David Clarkson: [00:25:50] And one more Danny, one more. Be unembarrassable it’s your money?

Lachlan McNeill: [00:25:56] That is gold, Dave. Absolutely.

DANNY : DE HEK: [00:26:00]

What I do with the guy that pays me 50 bucks at the moment, he was so hell bent and paying for my time, but it hasn’t paid moon’s voice.

Lachlan McNeill: [00:26:05]

Give him an easy way to do it. Yeah. Give them an easy way to do it.

I did I tell them to go to this little app and by me a coffee

David Clarkson: [00:26:12] And put a dish. It’s your money? Are you listening David?

Paul Starling: [00:26:16] Yeah, but you’ve made it difficult by telling him to go to an app because lots of people don’t like apps. So if you just send him an invoice.

Lachlan McNeill: [00:26:24] Can he pay through Paypal?

DANNY : DE HEK: [00:26:26] Oh, no, wait a minute guys. Let me answer. No, what am I, did I send them a text from my bank account number or not? Because he couldn’t log on to get my bank account number and with the email to pay. And he’s just ignored me. I mean, you know, am I looking like an idiot because I’m going after 50 bucks?

Paul Starling: [00:26:43] No, no,

Rob Woolley: [00:26:46] I think you, uh, if you go hard, um, when I started, um, And then now that I think about it, I’ve never gone hard after money, you know, like you just, you know, like you wait here, yellow and you wait for, until y’all like arrive in . If I don’t get any money or for trade me after a purchase for about three weeks, it would have to be, um, you know, I, I emailed them and asked them, Hey, have you paid? Because I can’t see it. Um, you know, like, and as you were an issue yeah. I guess, I guess I’m in a good position in a way. I have no power at all. So if, if a purchase a purchase is all for me and decides yellow at all for their mind, there’s nothing I can do about it. I except there is nothing I can do about it. And so, you know, like you don’t get all huffy about it. There was uh, the solution is, is that don’t worry too much about money.

Lachlan McNeill: [00:27:52] Sometimes be prepared to walk away. Yeah, don’t let it grind you down. Remember this, it cost you an ongoing chase chasing a $50 bill to spend a day chasing 50 bucks. It’s probably not worth it.

DANNY : DE HEK: [00:28:03] I just, I just literally delete the invoice and, um, and take them out of my context and, you know, and that’s what I do. Cause it’s not at one point $50 not worth it, but if I was charging $5,000 and I’d done the work. And then it’s then you have your terms and conditions and that’s where you chase it. Well, I’m not worried about $50, but I think I feel stupid actually going after it now. And I like, um, don’t be an embarrassing, I don’t mean the guy often he knew the price and then he said.

Rob Woolley: [00:28:32] He is put you in a position of, of you are having to pay because you are now uncomfortable, et cetera, et cetera, et cetera, because of him. Um, I ended up in there. Position, you know, like earlier on the week where, you know, like a lady had purchased plate off me, she hadn’t paid the postage. I asked her if that was, um, going to be a pickup. And she said, no, no. You know, as to Auckland, how much, well, everybody who has bought off of care to me for the last 15 years knows that it’s a, back’s wouldn’t really matter where you’re sending it to. And I said, it’s eight backs and she’s said, Oh, but can’t you put it in a blah, blah, blah. I said, it’s eight bucks. Do you not want to purchase your plate? I’m fine either way. And she didn’t come back. So I just, you know, like refunded the money.

Lachlan McNeill: [00:29:23] Yeah. Yeah. Um, I think if you have the closure. Yeah, yeah, yeah. I don’t, I don’t get stud up

DANNY : DE HEK: [00:29:29] Helen si going to speak. She’s getting pissed on. No, one’s listening to her. Okay. Hello. People, listen, try not to over-talk each other. Cause I’m getting her here.

Helen Oakes: [00:29:39] I was just going to say what’s Rob that you don’t need to send the goods until you get the money. So that’s a good thing for you. Yeah. Yeah. And if you do the service, then you’re waiting for the money. So yeah. Good for you.

Mark Scown: [00:29:55] Yeah. Well, spare a thought in my industry, I can do all the work and all the service and the statements of advice. And at the end of the day, if they then say, well, no, I you’re potentially down 10 or 20 hours of your time. And it’s non-billable.

Lachlan McNeill: [00:30:11] So the same thing of recruitment, you can do a lot of work for nothing, but my, my care business was the worst for that. You deliver a whole set of drawings to someone. Once they had the drawings, that’ll do value. You’ve done all the work. Um, and I did have a few people just never pay me, you know,

Paul Starling: [00:30:26]

For that Lachlan couldn’t you put them in a protected, what would you call it a PDF document that expires after a certain period of time?

Lachlan McNeill: [00:30:34]

I think these are often where we do these make funding up developers for always the worst problem. And because they didn’t have their own facilities, you’d actually have everything they could give to a client. And it was always on a tight deadline. You often deliver it in good faith. And then that, um, They would just not pay because they always had better places for the money. Engineers, architects. Absolutely fine. Never a problem. Um, but you can’t nearly protect them. Cause I opened up to have to for engineers, they need those files to better using their system, even to check them.

Paul Starling: [00:31:05] I guess the only thing you can do is keep it all online and like can’t download it until they pay.

Lachlan McNeill: [00:31:11] Maybe years ago I had a business, so I was a bit more basic, but honestly, degree cautious was the thing.

DANNY : DE HEK: [00:31:17] And they saying that haven’t done online. Sounds great. But there there’s a big up in some of that sort of stuff and having system around that can be a nightmare sitting up in itself. Yeah. Yeah. I was just one thing we didn’t discuss, which just came to my mind.

It’s probably just about going out as I’m talking. Oh, the customers that you do look after are the ones that pay promptly. Well, I think the thing too is those are the ones that, you know, you’ll drop everything for because they always pay promptly. And that’s how I view my bills when I’m paying them. I don’t pay on the due date.

I usually pay as soon as I can straight away knowing hopefully that’s how they, they work out.

Rob Woolley: [00:31:52] I think there’s another, uh, small point here, but it is an important one. All right. Enjoy your day mate, next week as it is, if we are application and how are you? We probably, after the case in a hurry for our own booths or holiday or whatever it is, and they. Most people are understanding. If you explain, um, you don’t have the money and if you tell them when the others are going to have. Well, the money that they need as well. And so, you know, we can explain it the other way too,

DANNY : DE HEK: [00:32:39] Good communication, I think would, um, personally feel embarrassed. If I tell people I don’t have the money to pay. And I think a lot of people would assume that you can bank roll them. And I shouldn’t really have that discussion, but I don’t know why that seems unusual, but I do feel that some people seem to think asking for money. It does seem to be. An unusual thing in a way, because, um, I just don’t understand why people don’t pay their bills more promptly or have a system.

Paul Starling: [00:33:08] Some people are serial debtors, so some

Lachlan McNeill: [00:33:11] People just are absolutely

Paul Starling: [00:33:13] just ourselves. You just can’t get away from that.

DANNY : DE HEK: [00:33:15] Yeah. Just to respect. So Tom, I’m trying to get, we’ve gone through a pretty fast meeting. Just if we could have some takeaways would be awesome, like that you got from today’s meeting.

David Clarkson: [00:33:27] Plan for your problems before you reach them, your plan plan for your problems before they have

Paul Starling: [00:33:34] processes in place. So when they’d bought that, as you know what you can do with them,

Rob Woolley: [00:33:40] If you have money in your pocket, it can stay in your pocket.

Lachlan McNeill: [00:33:47] But I’ll actually like Rob’s one in that offering disc. If you’re going to offer a special deal discounts, don’t Sally, your relationship with your own clients by offering them a discount sounds silly, but you know, I’ve just kept to someone outside your norm and therefore they don’t change the expectations of your clients. Does that make sense?

Lance Hastie: [00:34:09] Reiterate what we always try and hold true to is to know your value and to hold your standard. Hmm.

Rob Woolley: [00:34:16] That’s a big one. I think.

Helen Oakes: [00:34:18] That’s true because often, um, you will, you know, lower your standard by having a big sale or reducing things. And it makes you look like you’re desperate and cheap. You know,

Lachlan McNeill: [00:34:31] There is a thing in recruitment whereby clients will say, Hey, can I have a discount? And, and honestly we do say, okay, what bit don’t you want? Do you know what the guarantee. That’s exactly what we say. We don’t want to go and say, we can reduce the Karen tea. And you know, and in terms of which we, you know, if you want to prepay, we’ll offer you a discount and just make a rock solid. And if you say well, but so-and-so is offering, you know, they’ll do that for 5% and I’ll say, just say, grab them, just go for it.

DANNY : DE HEK: [00:35:02] Hmm,

Helen Oakes: [00:35:04] Maybe I should do that with mine. I often get people I get a lot of price shoppers and they don’t look. You know, I want people I send to, to any of the other day that say, I love your work. Can I get some shots, blah, blah, blah. Instead of going, how much do you judge for a Photoshop? That’s the first thing they say. And I’m like, Oh, hold on. You know, we haven’t discussed it enough. You just want to know how much they don’t know what goes into it, et cetera, et cetera. Anyway I think if you had a, Oh yeah, sure. I’ll do it for a lesser price, but I’ll give you smaller images and I’ll. What actionable, whatever, you know exactly what you said, Laughlin, and then they’ll go, Oh, Oh yeah. Maybe I should be paying the normal price, you know?

Lachlan McNeill: [00:35:44] Yeah, that’s right. And part of it is in the way you word it, you say, well, I don’t do that. I don’t just do the same price. You know that this is what you can, it’s your choice. And it’s like a, like an automatic machine. They press the button for this. So they unselect and therefore you get cheaper, you know what? You want, slow delivery on something. You can save a consult, a couple of bucks.

Helen Oakes: [00:36:02] Yeah, I have a base priced for the lowest level. And, um, I had some on the other day ask and the first question was, how much do you charge? And it catches me unaware, and I’m like, you need to look at my website, but I had to come up with the price there and there, which I do have, but it’s not, I like to deal with things. Generally, I say, what’s your budget, you know, but this person said they had, um, I told them the price and they said, Oh, well I only have about 300 or one or two photos. And he was saying, why don’t do photos almost takes the same amount of time to take 10 photos, you know, you know,

Lachlan McNeill: [00:36:41] But in terms of the takeaway, just getting back to here, Helen, Is I’m sort of looking at everyone here is almost have a separate product. If you need to bring money in the door, the sort of common wisdom is having a separate product. You’re not necessarily a physical product service, fence it off, and then you can have it ready and full, you know, I’m not pulling on, have a sale on stuff.

Paul Starling: [00:37:03] I’ve never had a sale

Lachlan McNeill: [00:37:04] but maybe you could have helpful. Paul would you get money to go quickly? If I say Paul. You and I are off to off to Australia. one woman song here, example here.

Rob Woolley: [00:37:20] And that is that. Um, if I’m online, then I can alter my income. Almost immediately if I want to. But years ago I had a shop in town and I decided I was going to have a sale. And I went from, you know, like a small, a four to, you know, like a lot of a fours. And then I closed the shop and I ended up with, you know, like the white all over and then I ended up with ads online blower, hell I hear their sale just on my front. Window, I would have not turned any extra money over, maybe at all, unless I was lucky as it was, I advertised it everywhere and I ended up with everything gone and about three weeks. So there are some products out there, right? That you can not turn over quick. And if I was having look at Academy training and I think, okay, if I want to turn over some money real quick, there’s no chance that I’d be able to do that. Absolutely. No chance at all.

DANNY : DE HEK: [00:38:39]

Right. We just need to finish the meeting. Um, anyone one of the top of the next week, if we do this.

We’ve got advertising. brand recognition is in the pipe for other meetings, but was anything that we sort of gleaned that guy that spoke yesterday. What did he talk on? That could have been interesting for us that maybe we could have as a topic. Cause that was some good, good things that we could discuss.

He talked about having a bench of people that you could ask for favors and side you pretty much. Yeah.

Paul Starling: [00:39:11] Sorry. Going back to that guys. Um, The one thing for the takeaway really is if you’re going to discount have a separate brand for your discount. If you look at all the big boys you’ve got spot and you’ve got skinny. Yeah. So you’ve, they’ve basically made a separate brand. So it doesn’t burn their prime

Lachlan McNeill: [00:39:30] brand. Absolutely. It’s like fenced off. Yeah.

DANNY : DE HEK: [00:39:35] So the one, the head free to me or something. Yeah. Yeah.

Helen Oakes: [00:39:38] It’s like what I put there have a go-to product that you can sell quickly, so it could be something completely different or different,

Lachlan McNeill: [00:39:44]

but it off, you might not do it under Helen Oakes.

So you might do it and a quick, quick pics or something. Yeah.

DANNY : DE HEK: [00:39:50] Another solution is having online courses. There was somebody who wants to know how to set up a website. Can they do it? I say you buy my course for $300 on how to set up a WordPress page. Yeah.

Lachlan McNeill: [00:40:01] And you can promote that. Yeah.

DANNY : DE HEK: [00:40:02] And that I want you to do it. And I go, well, I’m not doing it for throwing a backslapper sit there and watch the video and do it yourself mate,

Rob Woolley: [00:40:09] You know, even yeah. You know, like an ebook because well, you know, you could have, you know, like whatever it is, you know, like, and divide it up into, um, however you’re able, you know, like to get to the market in a hurry,

Lachlan McNeill: [00:40:23] but you’ll see, you’ve got to write the book or you’ve

Rob Woolley: [00:40:26] Right you’ve gotta write the ebook. You got to have all the products first, but yeah, they don’t all,

Lachlan McNeill: [00:40:31] yeah. But there was this guy by the way speaking.

DANNY : DE HEK: [00:40:36] Okay. Guys, very happy being here. I think it was

Lance Hastie: [00:40:42] Tony Wheeler.

DANNY : DE HEK: [00:40:45] Okay. So let’s go. So I’ll leave it for next week’s topic. Cause we,

David Clarkson: [00:40:49] well, I’m, I’m a, I’m a standard for brain written English.

Lachlan McNeill: [00:40:53] Okay. Yep. Okay.

DANNY : DE HEK: [00:40:56]

That sounds good. Brand Recognition

I know I’m trying to finish the meeting. Sorry. Passionate about it. It’s really cool. Sorry. I’m to be today, had a long week. So excuse me for my behavior.

Rob Woolley: [00:41:08] I like your top, by the way.

DANNY : DE HEK: [00:41:10] Wouldn’t you ever go to get interrupted? All right. So, uh, thank you for listening to our meeting. I hope you’ve got some insights from the meeting today, and please do feel free to subscribe and listen to other podcasts that we do.

And, um, we will be discussing Brand Recognition, I think. Was that the topic? I think it was next week. Yep. Yep. Brand recognition is right next week’s topic. So if you want to tune back in, we hopefully will give you some more insight. Thank you for listening.

P.S. If you like this podcast please click “like” or provide comment, as that will motivate me to publish more. Would you like the opportunity to be featured on the WHAT : DE HEK Podcast? You are welcome to INVITE YOURSELF to be a guest.

Leave A Comment