In the world of cryptocurrency, innovation often walks a fine line with exploitation. While blockchain technology has revolutionized finance and decentralized systems, it has also become a breeding ground for scams and Ponzi schemes that prey on unsuspecting investors.

In the world of cryptocurrency, innovation often walks a fine line with exploitation. While blockchain technology has revolutionized finance and decentralized systems, it has also become a breeding ground for scams and Ponzi schemes that prey on unsuspecting investors.

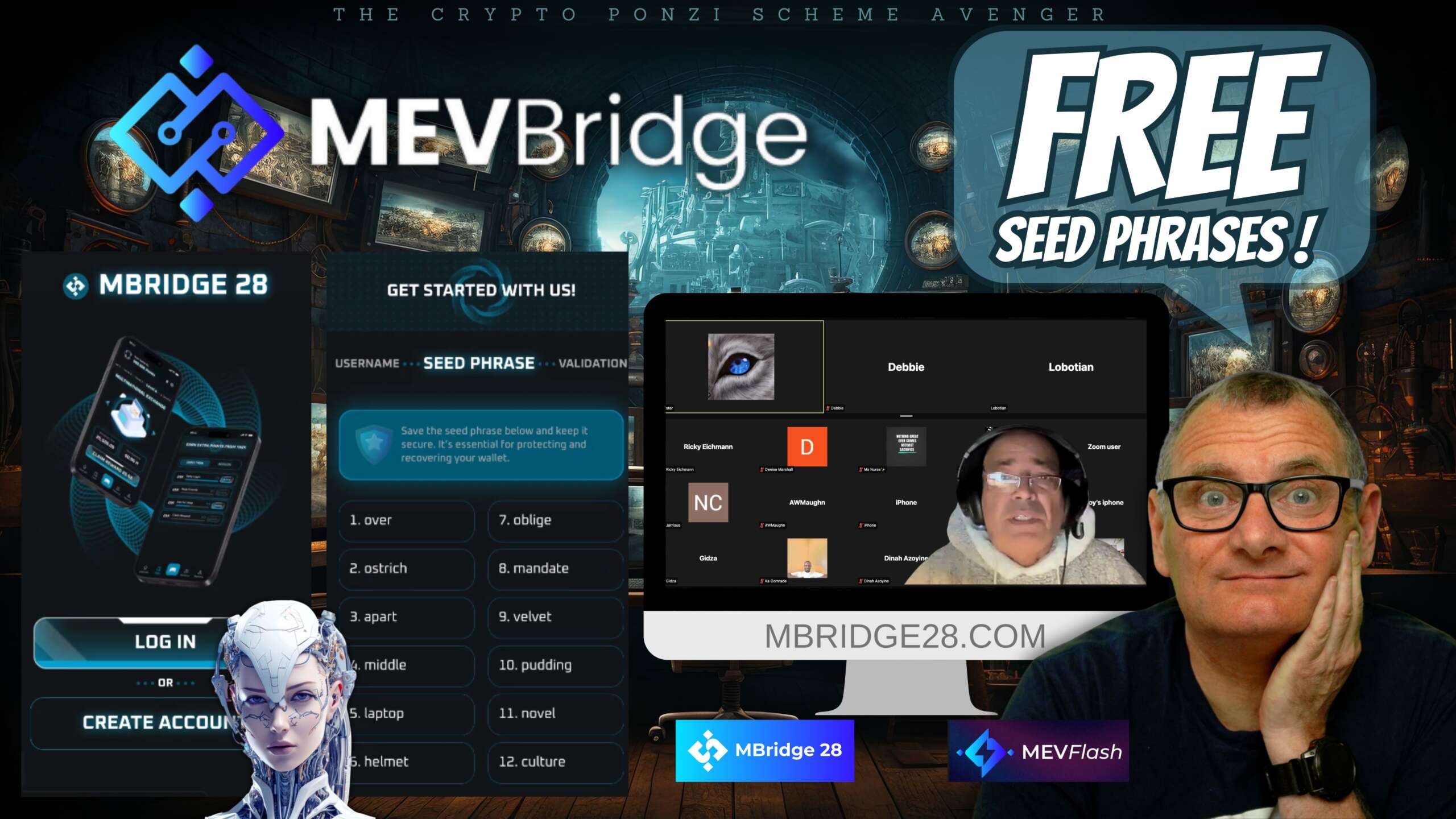

One such operation raising alarm is MBridge28, an apparent spinoff of MevBridge, which is riddled with red flags and questionable practices. This blog delves into the dangers of these platforms and how they exploit gullible investors under the guise of technological advancement and financial freedom.

What Are MBridge28 and MevBridge?

MBridge28 (mbridge28.com) and MevBridge (mevbridge.live) are platforms that claim to offer groundbreaking blockchain-based financial tools, including promises of high returns, instant liquidity, and secure investments. These claims are enticing, especially for novice investors and those unfamiliar with the intricacies of cryptocurrency. However, a closer inspection reveals significant concerns:

- Vague Promises: MBridge28 touts phrases like “democratizing liquidity” and “revolutionizing decentralized finance” without providing technical documentation or concrete evidence to substantiate their claims.

- Buzzword Overload: The platforms liberally use terms like “zero-interest loans,” “smart contracts,” and “DeFi innovation” to sound legitimate, but fail to explain how these features work in practice.

- Lack of Transparency: No verifiable information about the team, leadership, or operational details is provided, which is a hallmark of fraudulent schemes.

The ZOOM Meeting That Raised the Alarm

In a shocking ZOOM meeting, crypto multilevel marketers (MLMs) promoting MBridge28 revealed their lack of basic security awareness by exposing their seed phrases during the setup of multiple accounts. Seed phrases are critical for accessing and managing crypto wallets, and their careless disclosure not only compromises the security of their accounts but also highlights the unprofessional and risky nature of the operation.

ZOOM Meeting Attendees:

CryptoMan (Host), Dinah Azoyine (Co-host), Faister (Co-host), Debbie (Co-host), Silvia Detels, Ka Comrade, Gidza, Joy’s iPhone, Sewounda, AW Maughn, Jarrious Karena, Ms Nurse, Denise Marshall, and Lobotian.

These individuals—whether knowingly or unknowingly—are complicit in promoting a scheme that exhibits numerous warning signs of being a Ponzi operation.

Why MBridge28 and MevBridge Are Dangerous

1. Unrealistic Promises

- Zero-Interest Loans: The platforms claim to offer loans without any interest, which is financially unsustainable and unrealistic.

- Guaranteed High Returns: Promises of multiplying portfolios and achieving financial freedom are classic bait used to lure victims.

2. Lack of Regulatory Oversight

Neither MBridge28 nor MevBridge provide any indication of being licensed or compliant with financial regulations in their operating jurisdictions. Regulatory compliance is a critical factor in determining the legitimacy of any financial platform.

3. Poor Security Practices

The public exposure of seed phrases during the ZOOM meeting is a glaring red flag. If the promoters themselves cannot secure their wallets, how can they be trusted to manage investors’ funds?

4. Buzzword Marketing Without Substance

Using trendy blockchain terminology without providing clear explanations or technical documentation is a tactic often employed by scammers to appear credible.

5. Exploiting Vulnerable Investors

These platforms prey on people seeking quick financial gains. Many victims are everyday individuals who lack the technical expertise to identify fraudulent schemes.

How Ponzi Schemes Operate in Crypto

Ponzi schemes in cryptocurrency typically follow a pattern:

- Initial Hype: Promoters lure early investors with promises of high returns.

- Recruitment: New investors are encouraged to recruit others, creating a pyramid structure.

- Payouts from New Funds: Early returns are paid out using money from new investors, not from actual profits.

- Collapse: When recruitment slows, the scheme collapses, leaving the majority of participants with significant losses.

Protecting Yourself from Crypto Scams

1. Conduct Thorough Research

Before investing, always:

- Check the team’s credentials.

- Look for whitepapers or technical documentation.

- Verify partnerships and endorsements.

2. Beware of Unrealistic Claims

If a platform guarantees high returns with little to no risk, it’s likely a scam. Legitimate investments involve both potential gains and risks.

3. Prioritize Security

- Never share your seed phrases or private keys.

- Use wallets and exchanges with strong security measures.

- Be cautious of platforms that require you to deposit funds to participate.

4. Verify Regulatory Compliance

Check if the platform is registered with financial regulatory bodies in its operating regions. Non-compliance is a major red flag.

Why Exposing These Schemes Matters

Platforms like MBridge28 and MevBridge not only defraud individuals of their savings but also undermine trust in the broader cryptocurrency ecosystem. By exposing these scams, we can:

- Protect potential victims from financial ruin.

- Raise awareness about the tactics used by scammers.

- Hold fraudulent operators accountable.

Join the Fight Against Crypto Scams

At The Crypto Ponzi Scheme Avenger, I am committed to exposing scams and protecting everyday investors. My mission is to shine a light on these fraudulent schemes and disrupt their operations before more people fall victim.

If you have information about scams like MBridge28 or MevBridge, reach out anonymously through my website. Together, we can make a difference.

Final Thoughts

The allure of high returns and financial freedom can be tempting, but it’s crucial to approach such opportunities with caution. Platforms like MBridge28 and MevBridge exhibit all the warning signs of being Ponzi schemes—from unrealistic promises to poor security practices. By staying informed and vigilant, we can protect ourselves and others from falling into their traps.

Stay safe, stay informed, and join me in exposing these bottom feeders who prey on innocent investors.

Leave A Comment